Real Estate FAQs

Frequently Asked Questions

General

From getting you the best deal to keeping you on the right side of the law, Realtors abide by a code of ethics; they have insider information; they’re marketing masters and tough negotiators. In addition, Realtors are the only ones that can list your property on the Multiple Listing Service (MLS).

A sellers’ market favors sellers! Supply and demand determine where the market is, therefore, when the market has less than six months of available inventory it's considered a sellers' market, and because there are a few listings that often, homes sell quickly and for top dollar.

A buyers’ market favors the buyers! Supply and demand determine where the market is, therefore, when the market has more than six months of available inventory it's considered a buyers' market, and because there are abundant listings, buyers have several choices and are in a better-negotiating position, resulting in lower prices.

Supply and demand determine where the market is. A market with six months of available inventory (or a bit less) is often considered balanced.

FIRPTA or 'Foreign Investment in Real Property Tax Act' is a tax imposed on the amount realized from the sale of real property owned by a foreign seller.

Real Estate Owned —REO for short— describes a property that the bank comes to own because the borrower defaulted or could not financially afford to remain in the property, and efforts to sell the property, either at the short sale stage or at the foreclosure sale were unsuccessful.

Foreclosure is a legal process by which a defaulted borrower is deprived of his or her interest in the mortgaged property. Technically speaking, the only “foreclosure sale" is the one that occurs at the sheriff’s sale or other legal processes that transfers ownership from the borrower to a new buyer or the investor. A property owner is in pre-foreclosure when they default on their mortgage.

A foreclosure sale entails the sale of a property, commonly through an auction in order to satisfy an unpaid obligation. Depending upon state laws, this is done either under the authority of the court (judicial) or through a trustee sale (non-judicial).

A tax-deferred exchange under Section 1031 of the Internal Revenue Code.

A 1031 exchange allows you to dispose of investment properties and acquire "like-kind" properties while deferring federal capital gains taxes. The seller has 45 calendar days to identify the replacement property, and the exchange must be completed no later than 180 days after the sale of the original property OR the due date of the income tax return (with extensions) for the tax year in which the relinquished property was sold, whichever is earlier. The value of the replacement property and loan amount must be the same or higher than the sold property. Also, the entire property must be used for investment purposes; a primary residence is not allowed—even if some rooms are rented out. However, under some circumstances, the replacement property can eventually be used as a primary residence at some point in the future.

Most states with a capital gains tax offer a similar tax advantage too. Bottom line: a 1031 exchange lets you reinvest sale proceeds that would otherwise be paid to the government as capital gain taxes.

Let's assume you acquire a property for $800,000 four years ago. It has a current mortgage balance of $600,000 and has appreciated to $1,800,000. During the period you owned the property you have taken depreciation deductions of $100,000. Your long-term capital gains tax would total $225,000 calculated as follow:

$1,000,000 appreciation gain x 20%* = $200,000

$100,000 depreciation recapture x 25%* = $25,000

* Assumes 20% capital gains rate and 25% depreciation recapture rate.

The capitalization rate (cap rate) is the ratio of NOI to the asset value. NOI is the income generated after deducting all expenses. Simply put, you calculate your client’s return by subtracting all expenses from all income, and then dividing that number by the current value of the property.

Cap Rate = Net Operating Income / Price

Let's say your investor purchased an $80,000 single-family rental home in Detroit, and it rents for $975 per month. His or her total monthly expenses, including taxes, insurance, management fees, and repairs, might be around $393.50 per month, or $4,722 per year. This would leave your investor with an NOI of about $6,978 (cash flow). The cap rate would then be $6,978 divided by $80,000, which equals 8.74 percent.

If the investor is looking to finance, then the cash on cash return might increase. In this case, the investor might only have to put down $18,000 to buy the property, including closing costs. The mortgage payment would increase expenses, but the NOI would be divided into the $18,000 versus the $80,000. Adding a monthly mortgage payment of $344 to the expenses would result in $737.50 in monthly estimated expenses, or $8,850 annually. Subtract that from the gross income of $975 per month, or $11,700 annually, and you get an NOI of $2,850.

$2,850 / $18,000 down payment = 15 percent cash on cash return

Most landlords need help, especially if they don't know the local tenant laws or how to fully screen renters.

Good property management is the key to success for your investors. Property management companies should be fully licensed within the state and have at least a two-year track record of solid business experience. They must have a thorough tenant screening process, as well as a system for dealing with late payments or delinquent tenants. With today's technology, every property manager should use software that allows the owner to see what's happening in real-time with their property for full transparency.

Always review the management agreement to make sure you understand the property manager’s terms.

The MPI measures builder and developer sentiment about current production conditions in the apartment and condo market. It’s a weighted average of three key elements of the multifamily housing market:

- Construction of low-rent units-apartments supported by low-income tax credits or other government subsidy programs.

- Market-rate rental units-apartments built to be rented at the price the market will hold.

- For-sale units – condominiums.

The MOI measures the multifamily housing industry’s perception of occupancies in existing apartments. It’s a weighted average of current occupancy indexes for class A, B and C multifamily units, and can also vary from 0 to 100, with a break-even point at 50.

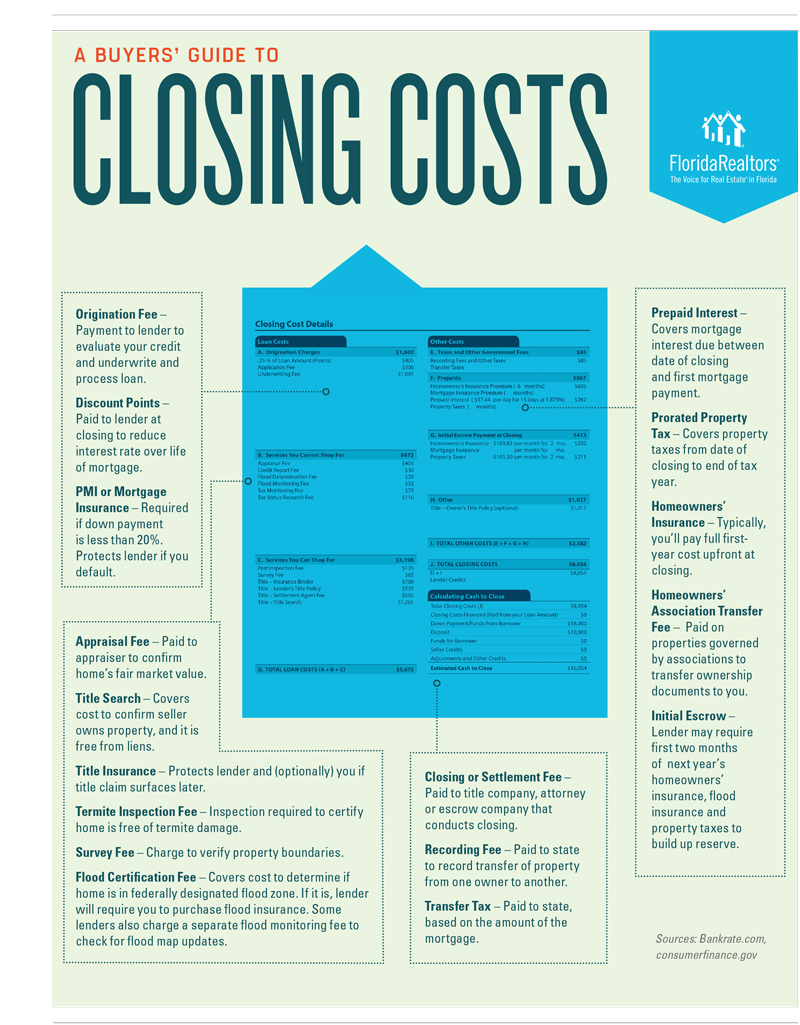

Closing costs include the loan, legal and title costs. In addition, it may include the fees and commissions to the Real Estate brokerage and other associated costs. All these figures are summarized in the government form called HUD-1.

Buyers

Historically, the early fall is the best season to buy and has provided an ideal mix of market conditions, including substantial inventory, waning competition, below-peak prices, and a slowing purchase pace.

Purchasing a home isn't the easiest thing in the world. Luckily we are here to give you some tips and help you in the process of buying your home. Here are the first steps of the home buying process

- Build a good credit history and improve your credit score (Higher credit score = lower interest rate).

- Get mortgage pre-approval.

- Find out what type of mortgages you qualify for.

- Set aside some money for the home inspection.

- Save up for the down payment (typically 10-20% of the property's value; if FHA-qualified, then possibly less, up to 3.5%).

- Consider closing costs which can include taxes, attorney's fees, and transfer fees (typically the closing costs are between 2-5% of the purchase price, there is possibly less if the finance term is an FHA loan or a cash deal).

- Consider utilities and monthly bills, such as homeowner's assessments.

On average, it could take about 4 months to buy a home, plus an additional 30-45 days to close on a home once it's under contract. However, this figure depends on the market you're buying a home in (whether it's a seller's, buyer's, or balanced market), it also depends on the term you're buying the home in (if it's an all-cash offer, you could probably close in two weeks instead of a conventional loan where the average is one month) and, finally, how determined you are when selecting your home (you can find your dream home in the first week or after three months).

Buyers do not pay commission, the commission for both the selling and buying agents is paid by the seller. However, there is a $345 transaction fee at closing.

It's not a surprise that a good credit score will help you to get a lower interest rate. A conventional loan requires a credit score of at least 620, but it's ideal to have a score of 740 or above, which could allow you to make a lower down payment, get a more attractive interest rate and save on private mortgage insurance.

In general, it's a 20% down with a conventional loan. But if you are buying using an FHA loan (Federal Housing Administration) requires as little as 3.5% down if you have a credit score that's at least 580 but it could go up to 10% if you have a credit score between 500 and 579. If you are a veteran and you're using a VA loan (Veterans Affairs Department) then you don't have to put any down payment. And, of course, if you're paying cash, that could be a negotiation point between you and the seller and that could be any figure that seller and buyer agreed on, however, the rule of thumb is 20%.

To be Answered

Earnest money, or good faith money, is a deposit that the buyer presents along with the "offer to purchase a property". There isn't a specific figure or percentage of the purchase price required, the amount is what the buyer deems convenient, but in general, it ranges between 1% and 10%, from there there is no limit. Of course, the higher the earnest money deposit, the more attractive the offer will be for the seller.

To Be Answered

Home inspections are an important part of the home buying process and even if they are not required, we do not recommend waiving them except in some circumstances, such as in new-construction, land purchase, or if you are in a situation with multiple offers and you are absolutely sure that you will not need it and you understand what you're doing. A home inspection, in addition to being useful for understanding any material defects in the home, gives you leverage to negotiate a credit or a discount on the purchase price. Also, a home inspection is a 'Contingency' that gives the buyer the option to back out of the deal without further explanation at any time during the 'inspection period' without forfeiting their 'Earnest Money Deposit.

To Be Answered

People are often shocked to learn that they can qualify for up to 10 investor loans through conventional banks. Those 10 loans can be used to purchase one- to four-unit properties. The investor will need a down payment of 20 percent to 25 percent for each property and approximately six months’ worth of reserves in place in order to qualify. However, he or she can use a portion of the rental income to qualify. These can be 30-year fixed-rate loans, which are recommended today given low-interest rates.

If you are buying a residential property with more than four units or a commercial property, you can apply for a commercial loan. These are generally shorter-term loans, though some long-term debt is available today. Investors need to be aware that if they obtain a short-term loan on commercial property, rates could be higher at the time they need to refinance or pay off the balloon note. This can radically affect the net operating income (NOI), which could force the investor to put more money down. Investors should always have a backup plan when taking on short-term debt.

The answer is yes, your clients can borrow against their 401(k), but make sure they understand the rules. He or she will have to pay that money back within a set timeframe or else they will pay penalties.

In order to use an IRA or 401(k) to invest in real estate, the investor must work with a self-directed IRA company that acts as a custodian or third party administrator. The IRA funds must always be handled by the custodian, never the investor. Any real estate purchase must be used for investment purposes only. For example, you can't buy a vacation home and then use it personally. The investor also can't be actively involved with the property—meaning he or she can't bang a nail or paint a wall on a property owned by their IRA. They must remain a passive investor and direct others to do the work for their IRA. There are massive penalties for violating these rules. With that said, billions of dollars are transacted in self-directed IRA accounts, and it is totally legal to purchase property within an IRA or 401(k).

You can self-direct their IRA or 401(k) to buy real estate, but you must speak with a custodian first to fully understand the rules. Some custodians I recommend are U-Direct IRA Services, The Entrust Group, and Equity Trust Company.

Sellers

Spring and summer are generally when people are looking to buy; however, homes are listed year-round, and there are always buyers willing to buy, so there is no better time to sell your home than when you decide to.

Sellers pay a 6% commission which is split as follows: 3% to the listing agent and 3% to the buyer's agent. Additionally, there is a transaction fee of $345 at closing.

No, you don't have to. The fact that a property was, or was at any time suspected to have been, the site of a homicide, suicide, or death or that an occupant was infected with HIV or diagnosed with acquired immune deficiency syndrome is not a material fact that must be disclosed in a real estate transaction.

Sellers aren’t required to complete this specific Florida Realtors Seller’s Property Disclosure –

Residential form (SPDR). However the sellers are under a duty per Florida laws —504 So.2d1361 (Fla.1987) — to disclose a home knows of facts materially affecting the value of the property that are not readily observable and are not known to the buyers.